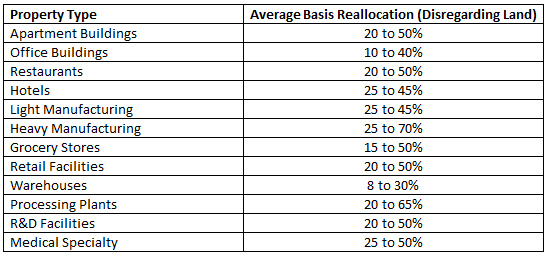

Cost segregation generates significant tax benefits through acceleration of depreciation deductions for property owners of commercial real estate. It is a growing service that can generate significant revenue opportunities for accounting firms. A cost segregation study is a systematic engineering based analysis, conducted by a trained professional, of all costs associated with a commercial real estate property. The purpose of the study is to allocate costs to either real property or personal property, and to classify those costs in the most optimal MACRS (modified accelerated cost recovery system) asset lives under the Internal Revenue Code, rulings, and existing Tax Court case law. By applying an engineered based study a property owner can depreciate a new or existing building in the shortest amount of time allowable rather than the longest. Typical basis allocation for certain properties are listed below.

© 2018 · gulfstreamcostseg.com